Quaker Meetings and Political Activism

by Jeffrey Aaron, Assistant Clerk, NYYM

Note: This is a revised version: Please disregard prior versions.

As a result of further legal review from a second attorney, after the first version of the article was disseminated, we have learned that the link we previously provided, from the IRS, sent to us by the first attorney we contacted, is actually an IRS “public gloss” that is incomplete and potentially misleading. The actual regulations are extensive. In addition, we have been advised that it is not good practice for us to provide legal advice other than from an attorney, which the prior version can be construed as doing, and which has also been done by emails from others in positions of authority in NYYM in response to the current political situation. In response to these concerns, this article has been vetted by an attorney. For specific legal guidelines for political action, please see the references below.

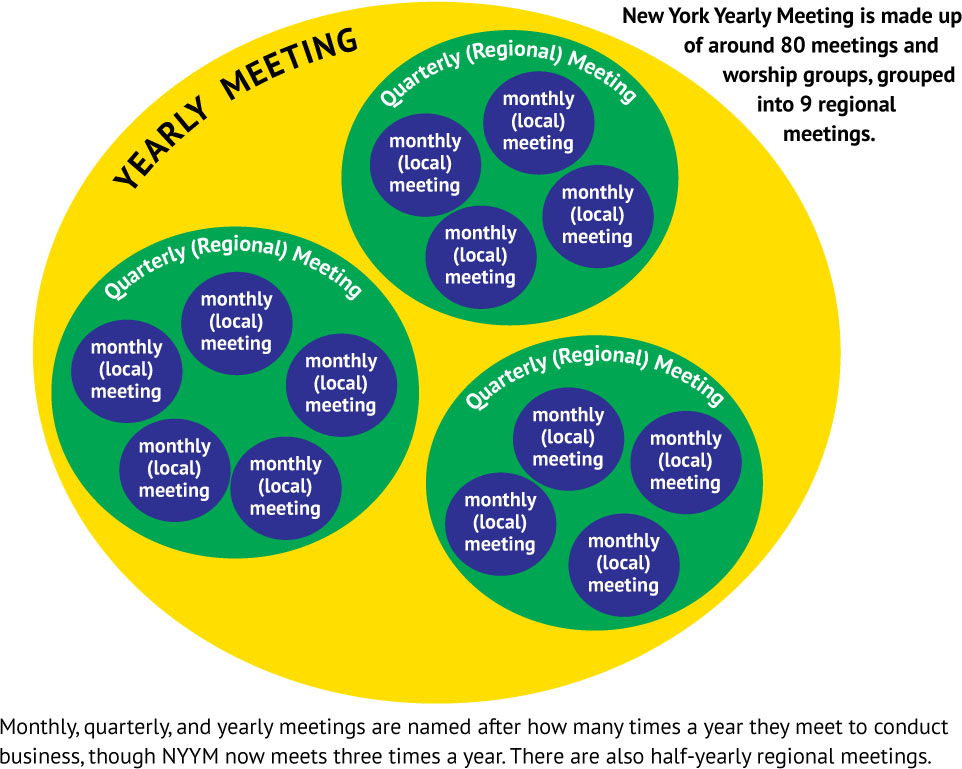

During a half month interval serving as Acting Clerk of NYYM while our Clerk was in China with limited email access, I was asked to consider taking interim action on two items: the signing on to online petitions in opposition to a Trump nominee and to the construction of the Pilgrim Pipeline, a NY State petroleum pipeline. With support from other members of the Liaison Committee, I chose not to take either action for several reasons: 1) I was concerned about the IRS regulations for religious non-profits and the possible loss of that status, 2) I was not comfortable opposing a candidate without authorization from the body as a whole in light of possible variant perspectives and opinions, including political, and leery of the many similar requests that may now emerge for other nominees, and 3) I question the current significance of signing onto online petitions, which have proliferated enormously, especially at this time of national discord, in contrast to an individual action by the Yearly Meeting such as a minute that we then disseminate. In addition, as to the pipeline, the defeat of the pipeline means the products will instead be carried by truck and rail, which is possibly even worse. It does not address the root cause: the extraction industries and our demand for their products. This concern requires additional inquiry and informed advice. This thinking does not preclude dissemination of the request data for individual action, which Friends may wish to take.

The general perception among Friends is that “we can’t legally lobby.” The reality is more complex than that. For specific guidelines, please see the attorney review on the NYYM web site: www.nyym.org/qr/nyympa/taximpl.html.

NYYM attorney Fred Dettmer, author of the advice provided on this link, summarizes as follows:

1. "Electioneering" means advocating for or against a candidate for public office (at the federal, state or local level). 501(c)(3) entities (i.e., meetings and churches) are prohibited from engaging in any electioneering. Doing so risks being fined by the IRS.

2. "Lobbying" means advocating for or against specific legislation (including referendums) at the federal, state or local level, including both advocacy directed at legislators and "grass roots" advocacy involving legislative proposals. It does not include political advocacy involving the executive, administrative and judicial branches of government. Lobbying is NOT prohibited, but churches and meetings are restricted in how much lobbying they can engage in without potentially jeopardizing their 501(c)(3) tax exemptions (for both donors taking a deduction for contributions and for meetings/churches being exempt from having to file returns and pay income taxes). That limitation is that churches/meetings are not supposed to engage in "excessive" lobbying activity. While "excessive lobbying" is not quantified by the law or the IRS's regulations, cases addressing the question have indicated that a church or meeting probably would only jeopardize its 501(c)(3) status if 15% or more of its total activities involved lobbying over a number of years.

3. To reiterate, there are absolutely no restrictions on a meeting or church engaging in political advocacy involving the executive, administrative and judicial branches of government. For example, urging the President or the Army Corp of Engineers not to issue a permit for completion of the Dakota Access pipeline is not lobbying activity.

Finally, the Internal Revenue Code does not prohibit meetings/churches from participating in the political life of our nation. The Code only authorizes the IRS to punish meetings/churches for engaging in electioneering or excessive lobbying (limited to the legislative processes) by denying them certain tax benefits. Whether a meeting/church should engage in a political activity if it risks losing its tax exemptions as a result can only be discerned in worship and discussion by its members.

February 16, 2017